Startup Funding With Zero Cash

Startup Funding With Zero Cash

The Complete Playbook for No-Money Business Loans

Launching a company without deep pockets is challenging but far from impossible. Today’s lending ecosystem includes government microloans, community lenders, equipment financiers, peer-to-peer platforms, and credit-building tools that can bridge the cash gap. This long-form guide unpacks every major “no-money-down” financing route, shows how to boost approval odds, and warns against predatory traps, allowing founders to secure capital without draining personal savings.

Understanding “Understanding “No-Money” Borrowing

Obtaining a startup loan “with no money” means two things simultaneously:

1. Minimal—or zero—cash contribution up front (no sizeable down payment).

2. Limited hard collateral beyond the assets being purchased (or none at all).

Lenders compensate for the higher risk by leaning on factors such as government guarantees, personal credit strength, projected cash flow, or the resale value of financed equipment. The key is matching your business stage and credit profile to the right product.

Step Zero: Strengthen Your Fundability

Before submitting any loan application, take these foundational steps:

• Incorporate and get an EIN. Formalizing as an LLC or corporation separates personal and business credit files and is a prerequisite for many lenders.

• Open a dedicated business bank account. Cash-flow statements pulled directly from a business account carry more weight than commingled personal statements.

• List a physical or virtual business address and phone. These details appear on underwriters’ compliance checklists.

• Establish early trade lines. Net-30 vendors such as Uline, Grainger, or credit-builder services like eCredable report on-time payments to Dun & Bradstreet, Experian, and Equifax, helping you score faster.

• Monitor your personal credit. Most startup lenders still rely on the founder’s FICO; aim for 690+ to unlock the best terms.

Loan and Credit Products That Don’t Require Up-Front Capital1. SBA-Backed Microloans

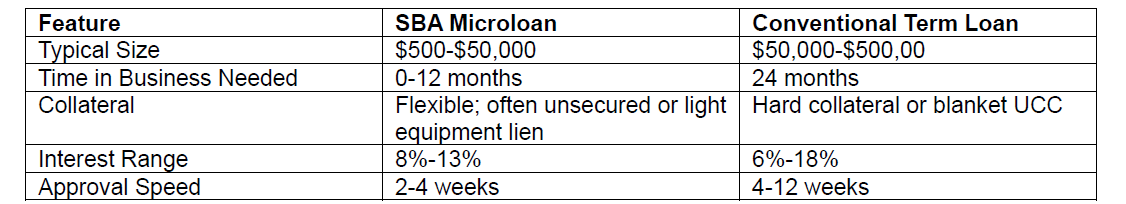

1. SBA-Backed Microloans

The U.S. Small Business Administration guarantees microloans of up to $50,000 distributed through nonprofit intermediaries. Average amounts hover around $13,000 and can fund inventory, working capital, or equipment without extensive collateral.

Microloan intermediaries frequently provide free business coaching, raising your odds of long-term success.

2. SBA 7(a) & Community Advantage Programs

For larger needs (up to $5 million), the 7(a) program offers 85% guarantees on bank loans, slashing the cash-down requirement—often to 10% of project costs. The Community Advantage pilot targets startups and underserved demographics with loans capped at $350,000.

3. Community Development Financial Institutions (CDFIs) & State Funds

CDFIs combine mission-oriented underwriting with flexible terms. Example: the Colorado Startup Loan Fund issues sub-$150,000 loans to founders lacking conventional collateral, focusing on rural and minority entrepreneurs.

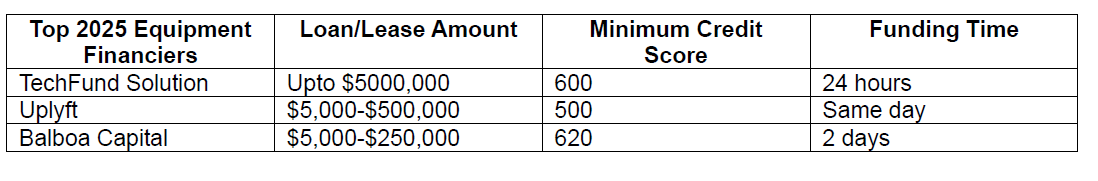

4. Equipment Financing & Leasing

Because the gear itself secures the debt, lenders advance up to 100% of purchase price with no cash down for qualified founders. Approval relies on the equipment’s resale value and your personal credit, not company revenue.

5. Business Credit Cards as Micro Lines

Startups can qualify for revolving credit using the founder’s Social Security number even without business revenue. Cards offer 0% intro APR periods (6–12 months) and build business credit if balances are paid on time.

6. Unsecured Business Lines of Credit

Online lenders extend revolving limits from $10,000 to $250,000 without hard collateral—albeit at higher APRs—by evaluating personal FICO and projected cash flow. Keep utilization below 30% to protect your credit score.

7. Merchant Cash Advances (MCAs)

MCAs provide lump-sum capital in exchange for a fixed percentage of future card sales. While approval is rapid (24–48 hours) and unsecured, factor rates can exceed 1.4 (equivalent to 40%+ APR). Treat MCAs as a short-term bridge, not core financing.

8. Invoice Financing

If you sell B2B on terms, lenders will advance 70%–90% of an unpaid invoice—cash lands in as little as 24 hours. Fees run 1%–5% monthly until the customer pays, making this model ideal for high-margin, fast-growing startups.

9. Peer-to-Peer & Debt Crowdfunding Loans

Platforms like Funding Circle, Kiva, and Prosper pool small investments into single term loans. Debt crowdfunding often settles in days and may beat bank rates, especially for founders with strong stories but limited assets.

10. Micro-Lending Platforms & Non-Profit Funds

Kiva’s zero-interest crowdsourced microloans and local nonprofit loan funds (e.g., California’s IBank Jump Start) specialize in first-time borrowers and can approve with thin credit files.

11. Vendor Trade Credit (Net-30/60)

Suppliers extend short-term credit on inventory, letting you preserve cash while proving payment reliability to bureaus. Combine multiple vendor lines to stack $10,000+ in interest-free working capital within 90 days.

Essential Documentation (Even When You Have No Cash)

1. Detailed Business Plan. Banks still expect financial projections and market analysis.

2. Personal Financial Statement. Lenders assess your capacity to backstop the debt.

3. Use-of-Funds Breakdown. Clarifies exactly how the loan accelerates revenue.

4. Industry Experience or Advisory Board Bios. Demonstrates management strength.

5. Traction Proof. Early purchase orders, pilot contracts, or wait-list metrics reduce perceived risk.

Strategies to Boost Approval Odds

Build Credit Fast

• Open 3–5 vendor tradelines reporting to D&B within the first month.

• Pay all obligations 10 days early to maximize PAYDEX score (aim for 80+).

• Dispute any personal credit errors immediately; 30-point FICO swings can shave 8% off APRs.

Offer Alternative Risk Mitigation

• Co-signer or guarantor. A partner with stronger credit can unlock unsecured products.

• Collateral substitution. Pledge office equipment or inventory instead of real estate.

• Royalty or revenue-share structures. Some lenders swap fixed payments for a sales percentage, lowering default risk.

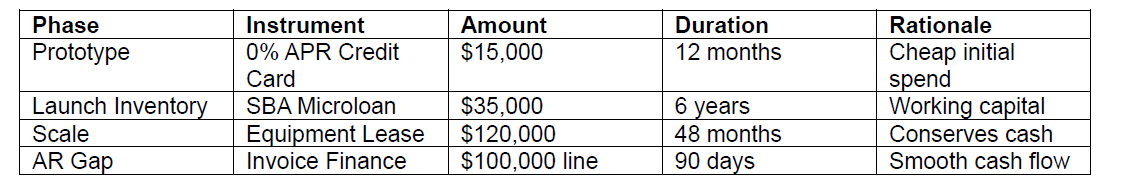

Ladder Financing

Combine complementary instruments to cover different phases:

Avoiding Common Pitfalls

• Predatory factor rates. MCAs with daily ACH drafts can strangle cash flow; always calculate effective APR.

• Blanket UCC liens. Some online lenders file liens on all company assets—read the fine print.

• Stacking advances. Multiple short-term loans trigger “loan stacking” clauses that can default agreements.

• Overlooking state usury laws. Crowdfunded debt must still comply with local rate caps.

Case Study Snapshots

Jamie, a first-time founder with a service-based startup, combined a $20,000 Kiva microloan (0% interest) for marketing spend and a $15,000 SBA microloan for equipment. By layering vendor trade credit for supplies, she launched with $50,000 in usable capital without pledging personal property.

Carlos, a SaaS entrepreneur with no revenue, secured a $25,000 business credit card at 0% for 12 months to build his MVP, then transitioned to a $100,000 unsecured line of credit after hitting $15,000 monthly recurring revenue, leveraging his improved credit profile.

Frequently Asked Questions

Can I get an SBA loan with zero revenue?

Yes. The SBA microloan and Community Advantage programs accept pre-revenue startups provided you present a viable business plan and personal credit history.

Will I need to provide a personal guarantee?

Most lenders—including SBA programs—require personal guarantees for owners with 20%+ equity, even if no collateral is pledged.

How fast can I receive funds?

• Business credit cards: Instant digital approval, physical card in 5-7 days.

• Equipment financing: 24–72 hours after vendor quote.

• Microloans: 2–4 weeks pending documentation.

• Invoice financing: Same-day funding once invoices are verified.

Does crowdfunding hurt my equity stake?

Debt-based crowdfunding operates as a loan, not an equity sale, so you retain full ownership while repaying principal plus interest.

Conclusion

Founders no longer need a six-figure nest egg—or property to pledge—to transform an idea into a thriving venture. By strategically combining SBA-backed microloans, mission-driven lenders, asset-based financing, credit-building tools, and peer-to-peer platforms, you can stitch together a funding stack that fuels prototyping, launch, and growth without draining personal savings. Strengthen your fundability first, match each financing product to a specific milestone, and remain vigilant against high-cost traps. Capital is out there; the roadmap above shows how to claim it.

References

•Lendio: How to Get a Business Loan with No Money

• American Express: Small Business Loans for Startups

• StartupSavant: SBA Loans for Startups — What You Need to Know

• Rho: The Startup Guide to Microlending

• BDC: No-Collateral Business Loans

• Bankrate: SBA Startup Loans: How to Get One

• Ramp: How to Build Business Credit Fast

• NerdWallet: Startup Business Loans—Compare the Best Options

• Fundera: Unsecured Business Lines of Credit

• Entrepreneur: Understanding SBA Loan Programs for Startups

• Entrepreneur: How to Build Business Credit Fast

• MicroStartups: How to Get a Microloan for Your Startup

• SBA.gov: The U.S. Small Business Administration Microloan Program

• eCredable: Best Business Vendors to Help Build Credit

• Entrepreneur: How to Get an SBA Microloan

• DigitalHill: Equipment Lenders for Startups

• SoFi: Crowdfunding vs. Small Business Loans

• Arc: What is Invoice Financing?

• Capital One: The Best Business Credit Cards for Startups

• Swoop: Equipment Financing Explained

• Young Upstarts: Crowdfunding for Startups

• Novuna: How Invoice Finance Can Help Growing Businesses

• NerdWallet: Best Business Credit Cards of 2024

• Colorado Startup Loan Fund

• StartupSavant: Equipment Financing for Startups

• Money.co.uk: Small Business Crowdfunding Explained

Lendio: How to Get a Business Loan with No Money

• American Express: Small Business Loans for Startups

• StartupSavant: SBA Loans for Startups — What You Need to Know

• Rho: The Startup Guide to Microlending

• BDC: No-Collateral Business Loans

• Bankrate: SBA Startup Loans: How to Get One

• Ramp: How to Build Business Credit Fast

• NerdWallet: Startup Business Loans—Compare the Best Options

• Fundera: Unsecured Business Lines of Credit

• Entrepreneur: Understanding SBA Loan Programs for Startups

• Entrepreneur: How to Build Business Credit Fast

• MicroStartups: How to Get a Microloan for Your Startup

• SBA.gov: The U.S. Small Business Administration Microloan Program

• eCredable: Best Business Vendors to Help Build Credit

• Entrepreneur: How to Get an SBA Microloan

• DigitalHill: Equipment Lenders for Startups

• SoFi: Crowdfunding vs. Small Business Loans

• Arc: What is Invoice Financing?

• Capital One: The Best Business Credit Cards for Startups

• Swoop: Equipment Financing Explained

• Young Upstarts: Crowdfunding for Startups

• Novuna: How Invoice Finance Can Help Growing Businesses

• NerdWallet: Best Business Credit Cards of 2024

• Colorado Startup Loan Fund

• StartupSavant: Equipment Financing for Startups

• Money.co.uk: Small Business Crowdfunding Explained

Find the Right Bookkeeping Solution for Your Business

Starting at (Reg.$299)

$99

Every business has unique financial needs, and we're here to provide the precise support that drives your success.

Let's discuss your specific goals in a no-obligation consultation.