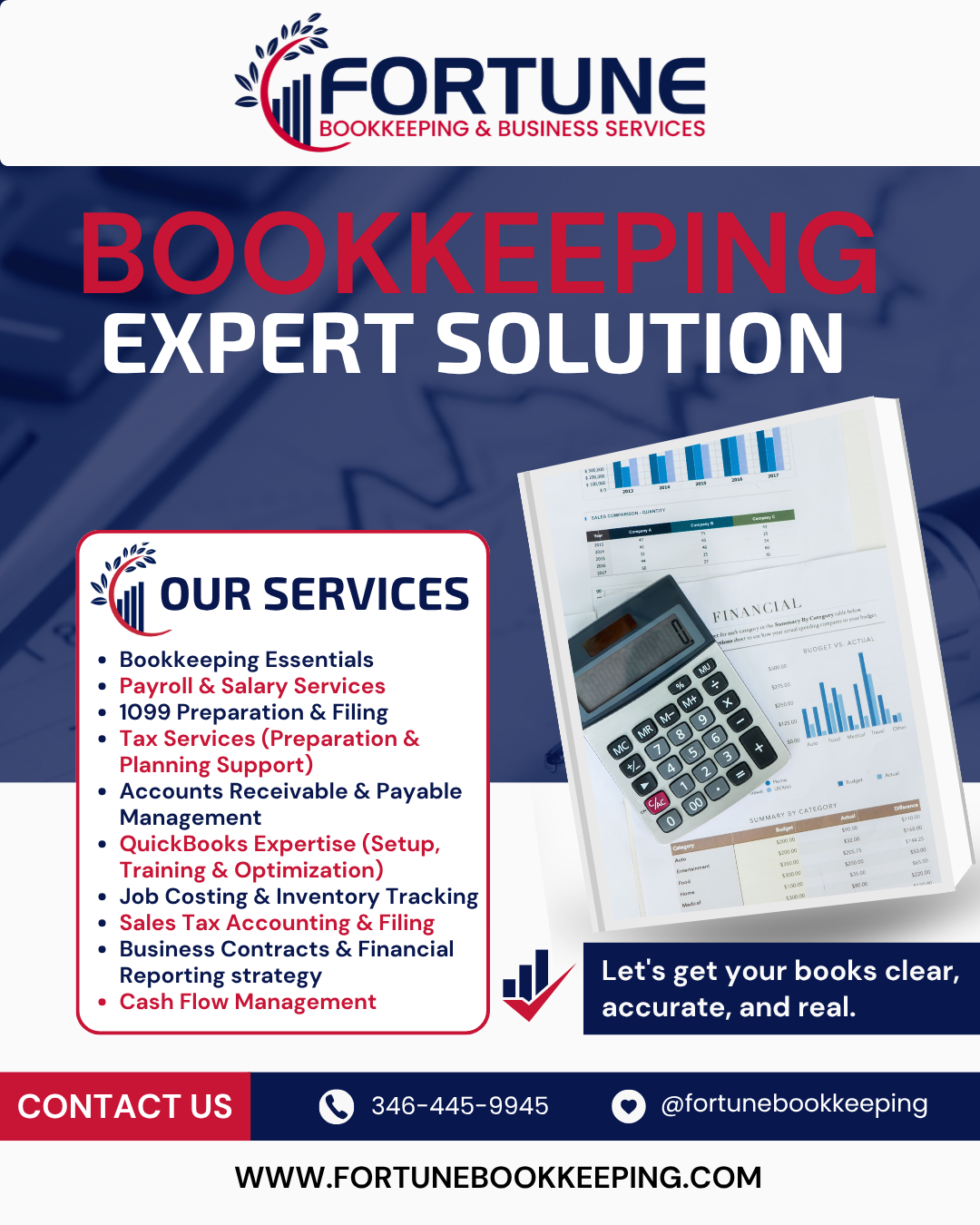

The Fortune Bookkeeping Resource Center

Explore our blog for essential insights and practical tips that add to your financial literacy and help you manage your finances effectively.

Empower Your Financial Future

Essential Financial Management Tips

Budgeting Basics

Smart Saving Strategies

Investing Insights

Empower Your Financial Journey

Most Read Blog Posts

Explore our most popular blog posts that provide essential insights into bookkeeping and financial management. These articles are designed to enhance your financial literacy and equip you with practical tips for effective financial decision-making.

Your Bookkeeping Questions Answered

What is bookkeeping?

Why is bookkeeping important for my business?

How often should I update my books?

What bookkeeping software do you recommend?

Client Success Stories

Real Experiences, Real Results

Sarah Johnson

2 months ago

Michael Smith

1 month ago

Emily Davis

3 weeks ago

Find the Right Bookkeeping Solution for Your Business

Starting at (Reg.$299)

$99

Every business has unique financial needs, and we're here to provide the precise support that drives your success.

Let's discuss your specific goals in a no-obligation consultation.

Subscribe for Financial Wisdom

Stay Ahead

We're always sharing new ways to simplify your books and boost your business understanding. Subscribe now and get our freshest insights delivered right to you.

Contact Us

Thanks for subscribing! You're all set to receive our latest updates.

Please try again later.